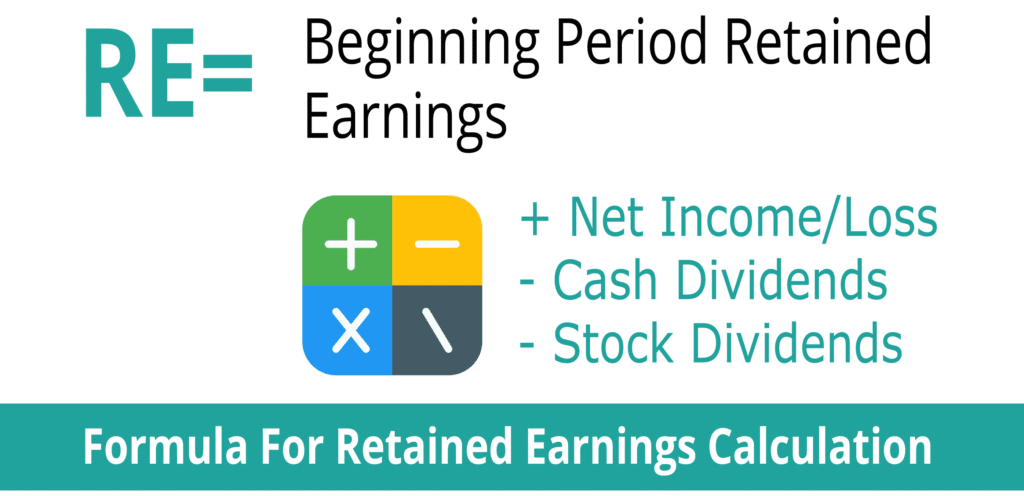

Retained earnings at the beginning of the period are actually the previous year’s retained earnings. This can be found in the balance of the previous year, under the shareholder’s equity section on the liability side. In our example, December 2023 is the current year for which retained earnings need to be calculated, so December 2022 would be the previous year. Meaning the retained earnings balance as of December 31, 2022 would be the beginning period retained earnings for the year 2023. This is the net profit or loss figure from the current accounting period, from which the retained earnings amount is calculated. A net profit would mean an increase in retained earnings, where a net loss would reduce the retained earnings.

Create a free account to unlock this Template

One of the most effective ways to recover from negative retained earnings is to reduce expenses. It may also include negotiating lower prices with suppliers or outsourcing certain tasks to reduce labor costs. External factors, such as economic downturns or natural disasters, can also contribute to negative retained earnings. If a company is affected by external factors beyond its control, it may struggle to generate profits. Accountants use the formula to create financial statements, and each transaction must keep the formula in balance.

Net income vs. gross profit

Profits generally refer to the money a company earns after subtracting all costs and expenses from its total revenues. Shareholders, analysts and potential investors use the statement to assess a company’s profitability and dividend payout potential. Retained earnings are reported in the shareholders’ equity section of a balance sheet.

Positive retained earnings

Business owners should use a multi-step income statement that also separates the cost of goods sold (COGS) from operating expenses. Businesses take on expenses to generate more revenue, and net income is the difference between revenue (inflow) and expenses (outflow). Expenses are grouped toward the bottom negative retained earnings of the income statement, and net income (bottom line) is on the last line of the statement. For instance, if your business has $20,000 left over after covering all its financial responsibilities—including operating expenses like employee salaries—you would report that money as retained earnings.

How to Calculate the Effect of a Cash Dividend on Retained Earnings?

Retained Earnings are a vital financial metric that sheds light on a company’s financial strength and growth potential. Investors and business owners alike can use this metric to make informed decisions and understand a company’s financial performance over time. Whether you’re an individual investor or a financial professional, keeping an eye on a company’s Retained Earnings is essential for a well-rounded financial analysis.

- Beginning retained earnings are then included on the balance sheet for the following year.

- If these strategies do not yield the expected returns quickly enough, they can result in a sustained period of negative earnings.

- CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- It may be done, however, if management believes that it will help the stockholders accept the non-payment of dividends.

- This balance can be relatively low, even for profitable companies, since dividends are paid out of the retained earnings account.

What Is Retained Earnings to Market Value?

Both cash dividends and stock dividends result in a decrease in retained earnings. The effect of cash and stock dividends on the retained earnings has been explained in the sections below. A company’s retained earnings refer to the amount of net income (or loss) accumulated since the beginning of operations minus all dividends distributed to shareholders. Undistributed earnings are retained for reinvestment back into the business, such as for inventory and fixed asset purchases or paying off liabilities.

For example, technology firms may reinvest more in research and development, resulting in lower retained earnings despite strong growth prospects. Understanding the industry’s norms and dynamics is crucial when interpreting retained earnings. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective. This reduction happens because dividends are considered a distribution of profits that no longer remain with the company.

Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter!). Retained earnings are therefore an accounting entry which acts as a reserve for unallocated earnings, pending arbitration. Retained earnings and profits are related concepts, but they’re not exactly the same. With plans starting at $15 a month, FreshBooks is well-suited for freelancers, solopreneurs, and small-business owners alike. Similarly, the iPhone maker, whose fiscal year ends in September, had $70.4 billion in retained earnings as of September 2018.

The company’s shareholders expect to have profits coming in from their investments. Retained earnings that a user will usually see on the Balance sheet are the remaining income after all debts to suppliers, employees, and creditors of the company have been covered. Negative retained earnings refer to the total amount of loss posted by a company when it exceeds any previously recorded profit. So if the company above posted a loss of $20,000 this year instead of a profit, it ends up with negative retained earnings of $10,000.